Why a Viral Investing Chart is Misleading

Fake News

You might have come across a chart circulating on Reddit, X (formerly Twitter), and other platforms. This chart claims to show that casino gamblers have better odds of turning a profit than stock market day traders. But don’t believe everything you see — this chart is misleading.

The Source of the Confusion

The origins of this chart are unclear, although it’s been popping up online recently. The figures it presents come from two separate studies: one about casino gamblers, published in The Wall Street Journal in 2013, and another about day traders, which began in 2004.

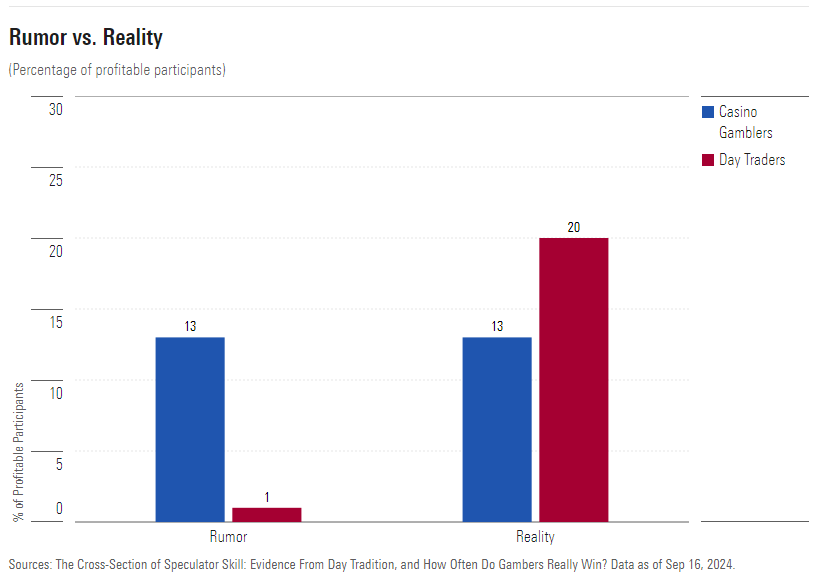

The problem is that these studies were conducted by different groups who didn’t coordinate their findings. By combining these unrelated pieces of data, the chart misrepresents reality. It claims, “13 out of 100 gamblers leave the casino a winner,” compared to “1 out of 100 day traders reliably beat the market.” But these figures were measured using completely different methodologies.

Comparing Apples to Oranges

Let’s start with the gamblers. The claim that 13% of gamblers win is slightly exaggerated. The correct number, according to a Harvard Medical School study cited by The Wall Street Journal, is actually 11%. Close, but this figure represents a simple percentage of those who won over a two-year period — and that includes gamblers who bet as few as four days over that time span.

On the other hand, the data on day traders is more complex. The claim that “1 out of 100 day traders reliably beat the market” comes from a study where researchers filtered out traders who made money by luck rather than skill. In fact, about 20% of day traders earned profits annually, but only a tiny percentage could consistently outperform the market.

It appears that the chart was created last year, when somebody combined those two findings. Doing so created a problem, because the research was conducted by different parties, neither of whom realized the other existed.

John Rekenthaler, vice president of research

Day Traders Are Not Like Gamblers

When you compare apples to apples, the success rate for day traders is much higher than the chart suggests. It’s not 13% versus 1% — it’s more like 13% for gamblers versus 20% for day traders. Based on this data, day traders are actually more likely to make a profit than gamblers.

Outdated Data, Different Markets

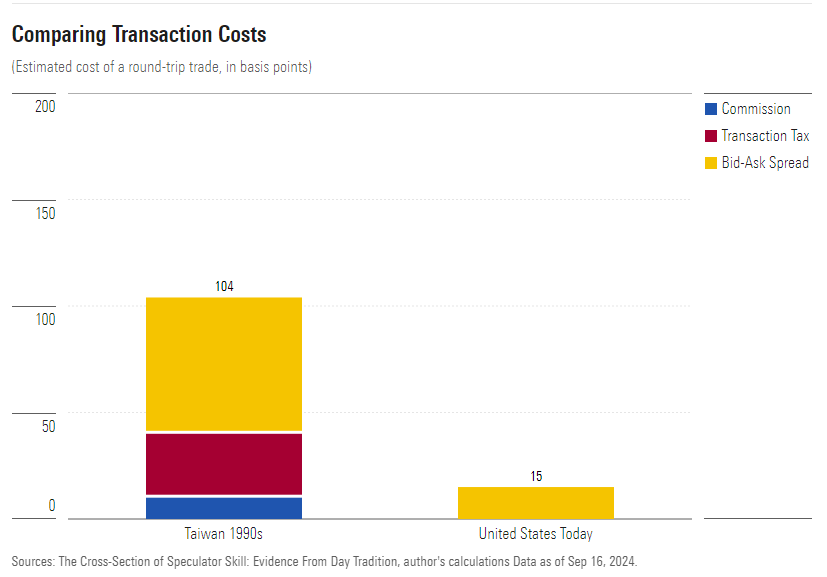

But that’s not all. The research on day trading was based on data from the Taiwanese stock market between 1992 and 2006 — a time and place with very different trading conditions compared to today’s U.S. market. In Taiwan, traders faced high commissions and transaction taxes, making it harder to turn a profit.

In contrast, modern-day U.S. traders pay no commissions, face minimal transaction costs, and deal with tighter spreads on major stocks, meaning that today’s day traders have a better chance of success than those in 1990s Taiwan.

Conclusion

Day trading, like gambling, carries risks. But comparing it to casino gambling based on an outdated and misleading chart does a disservice to both practices. While I personally don’t recommend day trading, as I believe it’s more speculative than sound investing, it’s important to base our understanding on facts rather than viral misinformation.